DeFi simply means decentralized finance. It is an umbrella term for peer-to-peer financial services on public blockchains, primarily Ethereum. With DeFi, you can do most of the things that banks support. Things like earn interest, borrow, lend, buy insurance, trade derivatives, trade assets, and more. But it is faster and does not require paperwork or a third party.

DeFi is built on three main things: Cryptography, Blockchain, and Smart Contracts.

Decentralization is part of what makes bitcoin hard to kill, I mean very hard to kill. DeFi takes this concept a step further. It takes the basic premise of Bitcoin and expands on it. It creates an entire digital alternative to Wall Street, but without all the associated costs. Decentralized exchanges and lending systems use blockchains like the Ethereum network, which was proposed by Canadian-Russian programmer Vitalik Buterin in 2013.

Five Pillars of Decentralized Finance

Stable coins – Stable coins are a type of cryptocurrency that is built to offer more stability than other cryptos because it is backed by assets like the U.S. dollar or gold.

Top stable coins are Tether, USD Coin, Binance USD, Dai.

| Cryptocurrency | Market Capitalization |

| Tether | $74 billion |

| USD Coin | $34.5 billion |

| Binance USD | $12.7 billion |

| Dai | $6.5 billion |

Lending and Borrowing – Crypto-financing allows crypto investors to borrow loans in cash or cryptos by offering cryptocurrencies owned by them as collateral. Crypto lending enables the lender to remain the owner of the crypto asset. However, the crypto offered as collateral cannot be used for trading or transacting during lending tenure.

Crypto investors who plan to HODL (crypto term for-Hold On for Dear Life) their crypto assets and have no plan to sell soon can lend the crypto assets and earn interest for that period. The interest earned is also called ‘crypto dividends’. It’s a simple way crypto investors can use to generate passive income by lending their crypto assets.

A crypto loan is a collateralized loan that one can get from a crypto exchange or some crypto-lending platform. The crypto loan functions similarly to a mortgage or a car loan, where you use car or house property as collateral, whereas in this case, you use your cryptocurrency to secure your loan funds.

Decentralized Exchanges – Decentralized cryptocurrency exchanges (DEX) operate in a decentralized manner, without any interference from a third party, allowing the users to use peer-to-peer transactions.

Insurance – Cryptocurrency insurance policies are designed to provide protection against cryptocurrency theft, losses as well as general cryptocurrency capital loss. Insurance as a means of responsible risk management is the next step in cryptocurrency’s ongoing evolution.

Margin Trading – It allows users to borrow funds to access greater capital and leverage their positions. It amplifies trading results, so traders can make a higher profit from their trades, without having to invest more capital.

For example, if we opened a Bitcoin margin position with a 2X leverage and Bitcoin had increased by 10%, then our position would have yielded 20% because of the 2X leverage. With no leverage, it would have been only a 10% ROI.

Margin leverage can also be 25X and even higher, despite the risk, the same position as described above would have yielded 250% (instead of 10% with no leverage).

For more information, please visit us @GoSpeedHub on Facebook, Instagram, and Twitter.

Follow @MindofOtis on Facebook, Instagram, and Twitter.

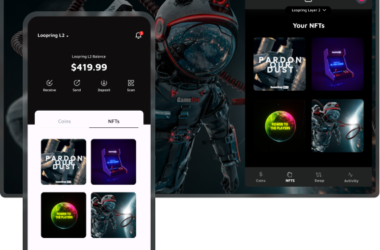

Image from Luv Murrell.